Urgency of Coal Transition

Accelerating the retirement of coal-fired power plants is a critical decarbonisation lever.

- Asia accounts for 50% of global greenhouse gas emissions, of which a third is from coal-fired power plants.

- If these plants operate as planned, they will exhaust about two-thirds of the carbon budget that we have remaining to keep the rise in global temperatures from increasing to within 1.5 degree Celsius.

However, phasing out coal is particularly challenging for Asia in three ways.

- First, the scale: Coal accounts for nearly 60% of power generation in the region. Asia’s energy demand is projected to increase by two-and-a-half times by 2050, on the back of economic development, population growth, and urbanisation.

- Second, the downstream social impact: Coal economy is also a key source of employment, particularly among the developing nations. Based on IEA’s estimates, of the 8.4 million employed globally across the coal value chain, more than 80% of these individuals are in Asia.

- Third, the profile of Asia’s coal: Asia’s coal plants are young, less than 15 years old on average. This makes the economics of phasing out coal more challenging, especially as new coal plants continue to be built to keep pace with energy demand.

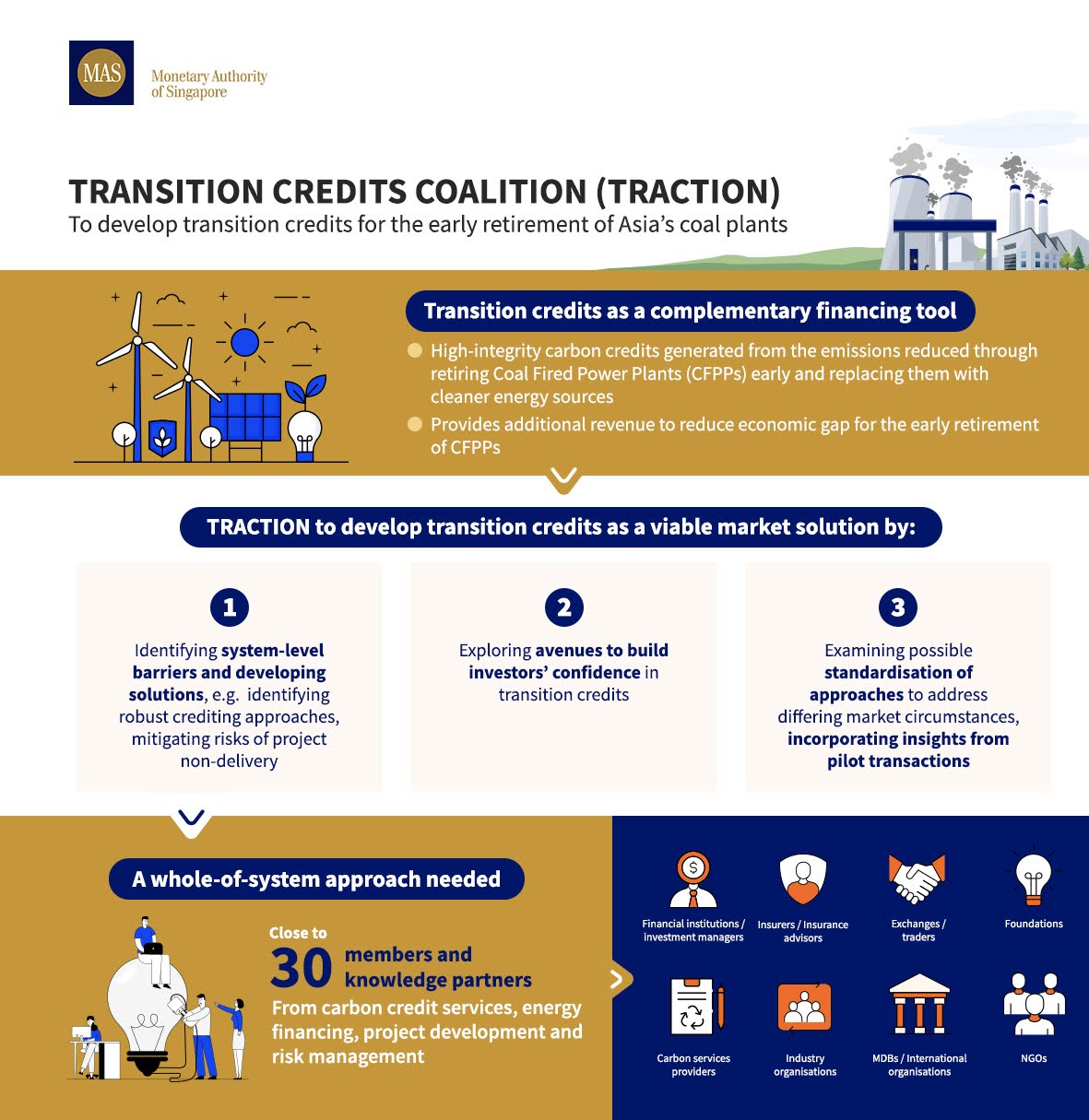

Transition Credits as a Complementary Financing Instrument

Notwithstanding existing efforts to finance the early retirement of CFPPs, the large and young fleet of CFPPs in Asia means that additional financing mechanisms are needed to improve the economic viability of such transactions and to crowd in significant private capital at scale.

In September 2023, MAS and McKinsey & Company jointly published a working paper setting out how high-integrity carbon credits (termed as “Transition Credits”), arising from the emissions reduced through retiring a CFPP early and replacing with cleaner energy sources, can be utilised as a complementary financing instrument to accelerate and scale the early retirement of CFPPs. The credits must be aligned with globally recognised standards such as the Core Carbon Principles (CCPs) set out by the Integrity Council of Voluntary Carbon Market (ICVCM) and other Article 6 integrity requirements, as mandated by the United Nations Framework Convention on Climate Change (UNFCCC). MAS will explore ways for transition credits to align with the CCPs, in consultation with the ICVCM.

Simplified cashflows from early retirement of illustrative CFPP in Indonesia by 5 years

Source: MAS and McKinsey working paper economic model

A whole-of-system approach is needed to develop transition credits into a viable market solution. To further develop the approach and establish solutions for Transition Credits, MAS launched the Transition Credits Coalition (TRACTION) with the support of industry partners. MAS also collaborated with partners to test the feasibility of integrating transition credits for early CFPP retirement through pilot projects.

MAS' Initiatives

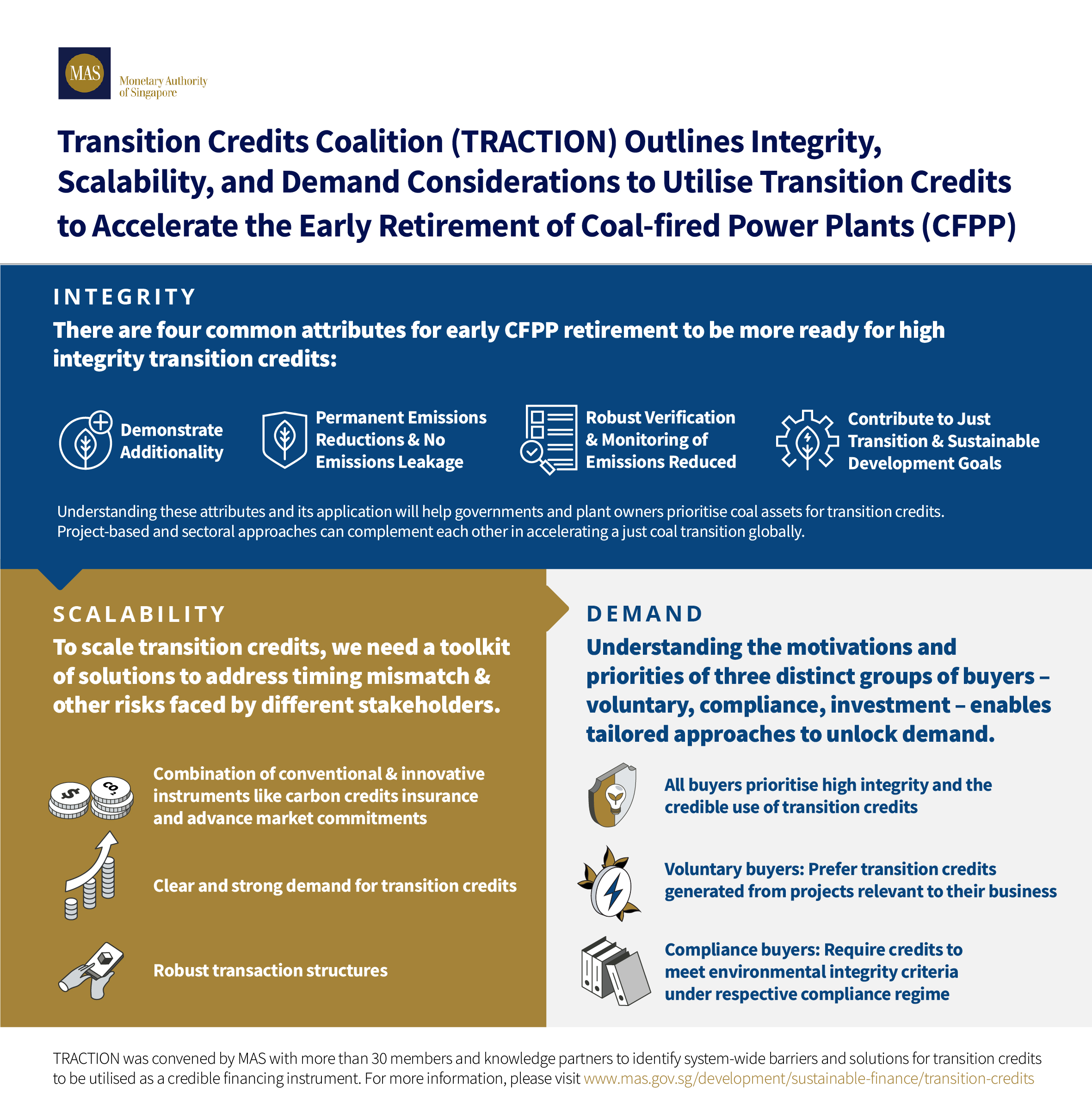

Transition Credits Coalition (TRACTION)

TRACTION, convened by MAS, comprises more than 30 members and knowledge partners across all key stakeholder groups from carbon credit services, energy financing, project development, risk management and non-governmental organisations.

With support from the Rocky Mountain Institute (RMI) as TRACTION Secretariat, TRACTION will identify system-wide barriers and solutions for transition credits to be utilised as a credible financing instrument. These include identifying robust crediting approaches that can be applied to regulated and deregulated electricity markets, mitigating risks of non-delivery of credits, and exploring avenues to build buyers’ confidence in transition credits.

TRACTION will conduct its work over a two-year period, up to Dec 2025. It is focusing on three areas of work:

Support high-integrity transition credits generation

Enable transition credits transaction scalability

Bolster buyers’ confidence and trust in transition credits

| Financial Institutions / Investment Managers | |

| Bank of America Citi Clifford Capital Climate Smart Ventures DBS Bank Limited GenZero HSBC MUFG Mizuho Financial Group OCBC Sumitomo Mitsui Banking Corporation Standard Chartered Bank Temasek United Overseas Bank Limited |

|

| Insurance Advisors | |

| Aon Howden Insurance Brokers |

|

| Exchanges / Traders | |

| AirCarbon Exchange Climate Impact X Vitol Asia |

|

| Foundations | |

| The Rockefeller Foundation |

|

| Carbon Service Providers | |

| Asia Carbon Institute BeZero Carbon Global Carbon Market Utility Gold Standard Sylvera |

|

| NGOs / Multilateral Development Banks / Industry Organisations / International Organisations | |

|

Asian Development Bank

|

Pilot Projects

- ACEN Corporation

For more information, please see: COP28: ACEN, The Rockefeller Foundation and Monetary Authority of Singapore partner to pilot the use of Transition Credits for the early retirement of coal plants and Coal-to-Clean Credit InitiativeFor information, please see: COP28: The Rockefeller Foundation, ACEN Corporation and Monetary Authority of Singapore partner to explore phasing out coal plant in Philippines Read more information about The Rockefeller Foundation's Coal-to-Clean Credit Initiative: The Rockefeller Foundation and GEAPP To Design the World’s First ‘Coal-To-Clean’ Credit Program in Emerging Economies , to accelerate the retirement of the South Luzon Thermal Energy Corporation coal plant in Philippines. Climate Smart Ventures, an advisory firm focused on energy transition, will be coordinating the project; and - Asian Development Bank (ADB), which is advising the Government of Philippines over the retirement of a coal plant in Mindanao under its Energy Transition Mechanism

Read more information about ADB’s Energy Transmission Mechanism .

While TRACTION members and partners will not be directly involved in any pilot transactions, insights from these pilots will contribute to TRACTION’s work in examining the possible standardisation of approaches that can be replicated across markets.

Watch the latest update from the pilot partners at FAST Conference 2024: From Commitment to Action: Accelerating Change through Transition Credits | Ecosperity Week 2024 (youtube.com )

Latest Updates

- "Achieving Scale and Impact in Transition Finance" - Opening Remarks by Mr Leong Sing Cheong, Deputy Managing Director (Markets & Development), Monetary Authority of Singapore, delivered on 14 Nov 2024 at COP29 Singapore Pavilion Finance Day

- Interim Report Presentation (1.2 MB) by Ms Pamela Lee, Deputy Chief Sustainability Officer, Monetary Authority of Singapore on 14 Nov 2024 at COP29 Singapore Pavilion Finance Day

- Interim Report Infographic published on 14 November 2024

- “Three Key Components of Market-Based Solutions – Ambition, Arsenal and Actors” - Opening Speech by Ms Gillian Tan, Assistant Managing Director (Development & International) and Chief Sustainability Officer, Monetary Authority of Singapore, delivered on 27 September

2024 at the World Bank – MAS Joint Event “Market-Based Approaches to Coal Transition”

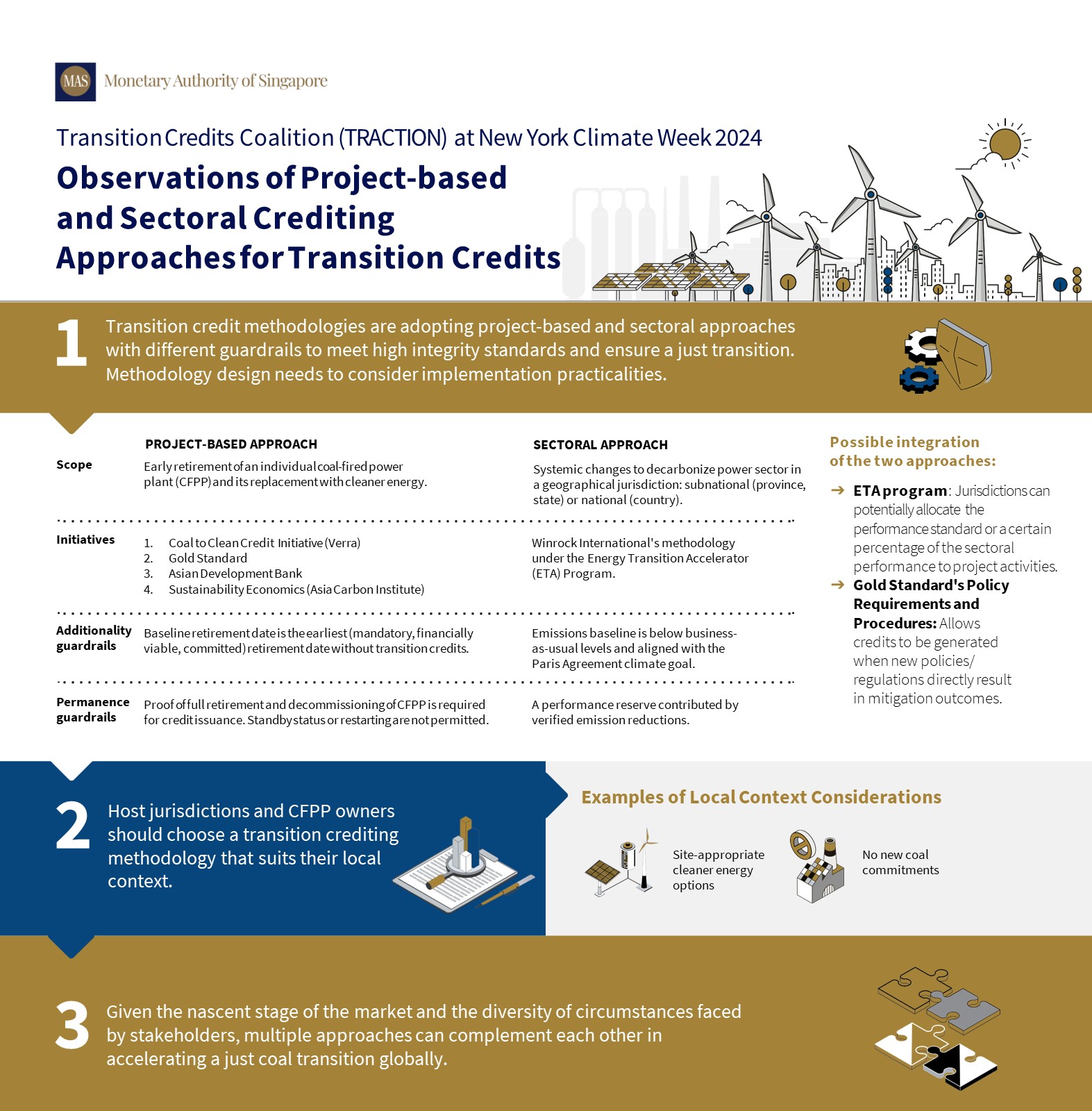

- Early Observations of Project-based and Sectoral Crediting Approaches for Transition Credits published on 27 September 2024

-

For more information, you may refer to presentation deck (370.4 KB).

-

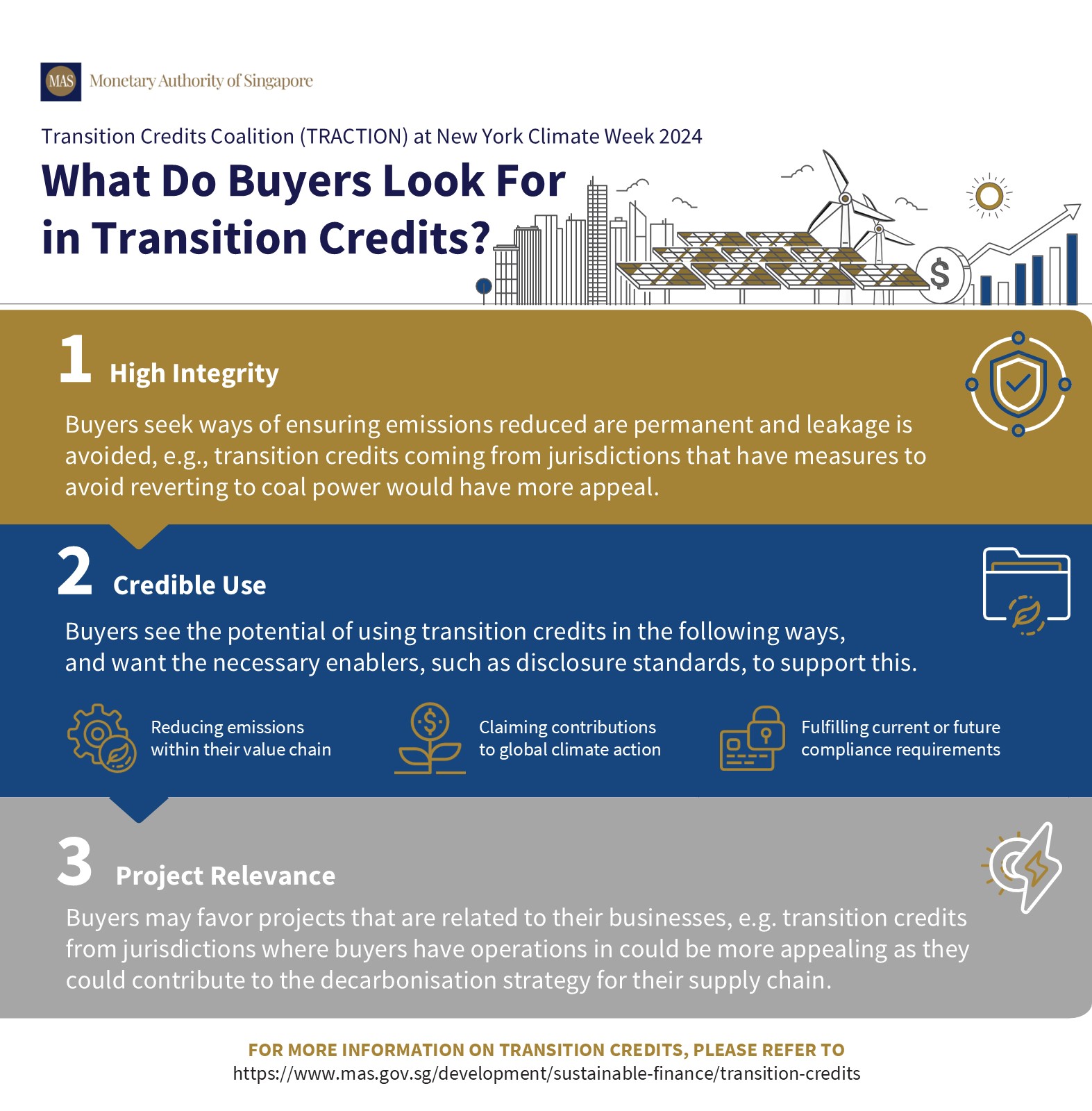

What Buyers Look For In Transition Credits published on 2 October 2024

-

“Financing Asia’s Transition – Bridging Global Ambition to Regional Action and Impact” - Opening Remarks by Mr Chia Der Jiun, Managing Director, Monetary Authority of Singapore, delivered on 17 April 2024 at the Financing Asia’s Transition (FAST) Conference.

- Update on progress of pilot projects: From Commitment to Action: Accelerating Change through Transition Credits | Ecosperity Week 2024 (youtube.com)

- "Getting Transition Finance Right" - Speech by Mr Ravi Menon, Managing Director, Monetary Authority of Singapore, delivered on 3 December 2023 at the COP28 Singapore Pavilion Finance Day

- MAS media release, published on 4 December 2023, on MAS Launches Coalition and Announces Pilots to Develop Transition Credits for the Early Retirement of Asia’s Coal Plants

- "Harnessing the Potential of High-integrity Carbon Credits for Managed Phaseout of Coal" - Opening Remarks by Mr Leong Sing Chiong, Deputy Managing Director (Markets & Development), Monetary Authority of Singapore, delivered on 26 September 2023 at the MAS-McKinsey Working Paper Launch Event.

- MAS media release, published on 26 September 2023, on MAS and McKinsey Explore the Use of High-integrity Carbon Credits to Accelerate and Scale the Early Retirement of Asia’s Coal-fired Power Plants

- MAS and McKinsey Joint Working Paper, published on 26 September 2023, on Accelerating the Early Retirement of Coal-Fired Power Plants through Carbon Credits